January 2021 Net-Worth Transparency Post 1

Financial Benchmarks and Goals

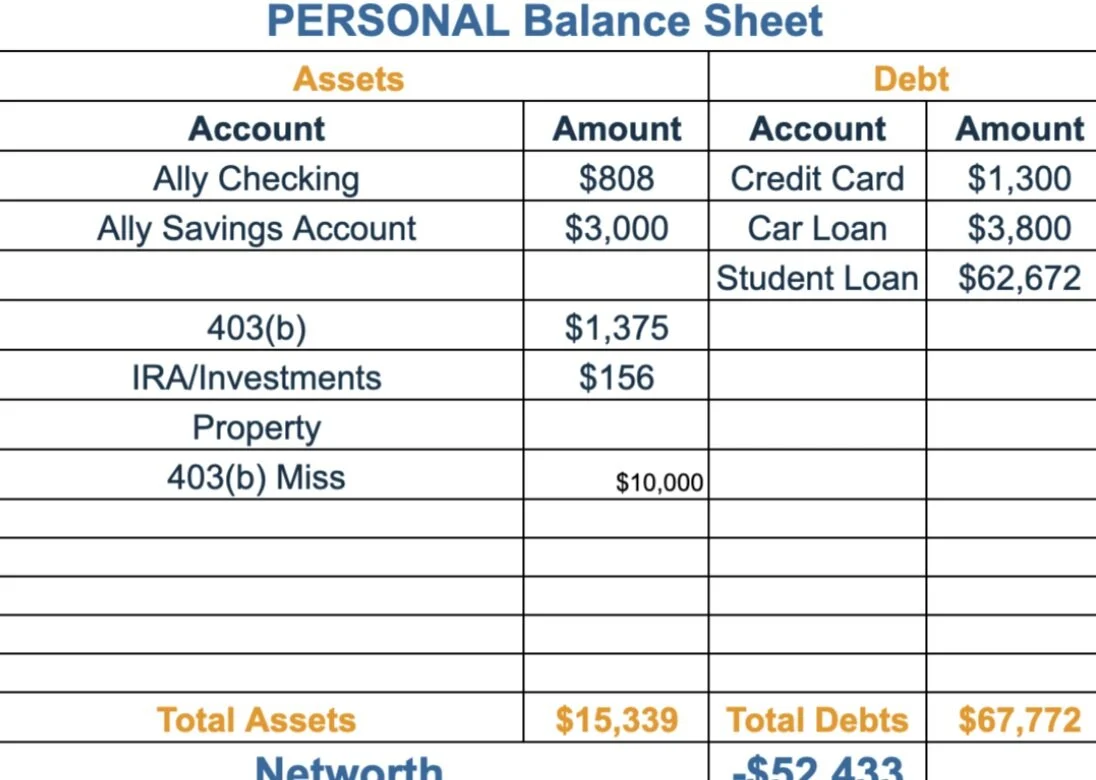

In this post, I wanted to get into the nitty-gritty of my financial situation. As a financial wellness writer, I think it’s important to be as honest with you so you can find a solution in your own life or help others. I will break down all of my debt, investments, and bank balance.

Looking at net-worth used to be the most depressing experience for me. I would ball up in a corner and cry. I’d get mad at the man for his privileges, and I would drive to Shake Shack and stuff my face in delicious but hurtful food (I’m a Lacto).

I’ve come to learn that a negative net-worth is okay. It’s what you do with your net-worth after you know your numbers. I use my numbers for motivation and accountability so that I am able to make positive decisions around my moolah.

How do you create Financial Benchmarks? Money Dates

Let’s be real, making the leap to writing down financial benchmarks, and sticking to them is a challenge. I’ve learned that it’s best to create set Financial Benchmarks is creating sacred time between you and your money so that you can

Money dates are a way to create a new relationship with your money. A Money Date is an act of setting the time on your schedule weekly, monthly, and quarterly to look at your money.

The ultimate goal for you is to create a habit of looking at your money. Also, money dates sound better than budgeting because of the word association. We have a negative emotion around the word budget. Money Dates don't have to be one type of budgeting meeting; it can handle a variety of things. There are four money dates that you can have throughout the month.

4 Types of Money Dates:

Planning Dates

Guidance Dates

Inspiration Dates

Education Dates

For setting the Financial benchmarks I used two types of Money Dates: Inspiration and Planning Money Date

Money Date 1: Inspiration Money Dates

Inspiration Money Dates gives me motivation and inspiration from others. Having creativity with your money helps you track your planning money dates and creates your vision boards for success. On my first money date, I made a huge list of positives aspects that are going on in my life. Here is the list that I made to celebrate the wins.

Increased my salary by 75%

Got a full-time job

Made money from side hustle

Got engaged

Switched my full-time business back to a side hustle

Finished graduate school

Money Date 2: Planning Money Date

Planning dates are the blueprint behind your money. It helps you plan what exactly you want to do with your cash flow. You figure out what to do with your payments, bill, and paychecks. For my next money date, I pulled my financial information. My debts and assets to find out what my net worth.

Currently, I have a net worth of $-52,433

My debt : $67,772

Assets: $11,375

Total time: 4 hours - It took time to pull up each of my accounts on their individual site for each of my accounts. For the most part, I keep it pretty simple. I didn’t have much debt for years, but I didn’t have any investments or knew what to do about them. In three years, I went from being kicked out of my apartment because I started a business planning a better financial future.

Financial Goals 2021

I have four goals for 2021. I kept it simple because it’s easier to track it

Merge my finances with my soon to be husband

Save 10k

Add money to Roth IRA

Finish my ACFPE Financial Counseling Certification